Commercial space on offer

Commercial space supply and marketing readiness at a glance

The commercial space available refers to undeveloped, commercially usable areas that are legally shown in land use plans (F-Plan) or development plans (B-Plan). These include

- Commercial (G) and mixed development areas (M) in the land use plan (F-Plan) and industrial estate (GE),

- restricted commercial area (GE-e),

- Industrial area (GI),

- restricted industrial area (GI-e),

- Mixed area (MI),

- Core area (MK) or

- Special area (SO for various purposes: large-scale retail, hotel/sports/leisure, science/research, medical university or airport expansion) in accordance with BauNVO.

A legally valid B-plan (usually developed from the F-plan) and an existing development are required for a building permit. If there is already a concrete interest in use, the F-plan is often amended and the B-plan drawn up in parallel.

On the other hand, in some cases, decisions are made to draw up development plans, but the process is then not pursued further - often for years - because, for example, a prospective user has postponed his or her project. The time it takes to mobilize B-plan and F-plan areas can therefore vary greatly depending on the individual case.

In addition to the legal validity of the development plan, the status of the development and the accessibility of the municipality via municipal property or a municipal project development are also decisive for the marketability or availability of the land.

In the following, the availability of space is divided into four categories (Fig. 7; Table 2):

- B-plan, immediately marketable: sites with a legally binding B-plan, existing development and in public ownership. In total, 45 ha of commercial land in the Hannover Region will be classified as immediately marketable in 2023. The figure has therefore fallen compared to 2022 (55 ha).

- B-plan, marketable at a later date: Areas with a legally binding B-plan that have not yet been developed and/or are not in public ownership. At 126 ha, this volume of land has fallen slightly compared to the previous year (137 ha).

- F-plan: Areas for which an F-plan designation exists but no legally binding B-plan and for which there is generally no development. Here, the municipality documents its basic planning objective as part of the preparatory urban land-use planning. However, it remains to be seen whether and when these areas will actually receive building rights through binding urban land-use planning (legally binding land-use plan, development). The majority of these areas are privately owned. At 451 ha, the size of the F-Plan areas has only decreased slightly compared to the previous year (471 ha).

- Potentially reusable brownfield sites: Due to generally considerable restrictions on use (e.g. old buildings that can no longer be used, contaminated sites, inadequate urban land-use planning), these sites are the least ready for marketing. At 88 ha, the volume of brownfield sites is higher than in the previous year (72 ha).

- At present, preliminary areas (intended new designation of commercial areas without

B-plan or F-plan) in the order of approx. 526 ha are currently under discussion. According to a survey of the municipalities, around 26 ha of these preview areas could currently be converted into building rights in the short term and 115 ha in the medium term.

The following chart illustrates the development of the total supply of commercial space, including potentially reusable brownfield sites, from 2014 onwards. The supply has fallen by 31 % over the last ten years (Fig. 7).

When considering the overall supply, it should be borne in mind that potential areas without a legally binding development plan will be considerably reduced in the course of the planning process, for example by areas for development and public green spaces.

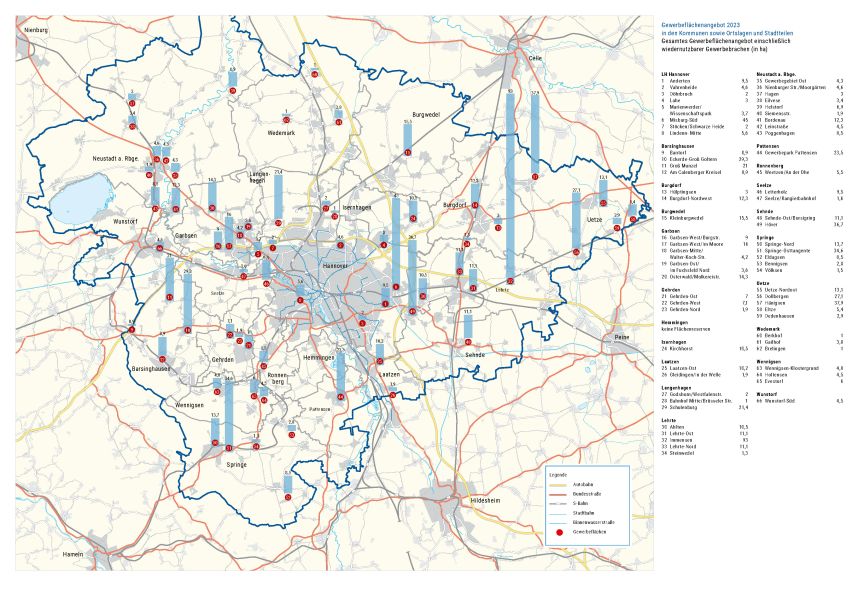

Table 2 shows the distribution of the current supply of commercial space across the respective municipalities:

- Only Garbsen (14 ha) and the state capital Hannover (11 ha) currently have larger areas of immediately marketable development plan land (> 5 ha) .

- Land reserves with legally binding development plans (available either immediately or at a later date) of over 10 ha are located in the state capital Hanover (24 ha), Pattensen (24 ha), Springe (21 ha), Garbsen (18 ha), Uetze (16 ha), Burgwedel (16 ha), Lehrte (12 ha) and Sehnde (11 ha).

- F-plan reserves (without a legally binding B-plan) of more than 20 ha are located in Lehrte (115 ha), Barsinghausen (59 ha), Uetze (53 ha), Springe (40 ha), Sehnde (37 ha), Neustadt (36 ha) and Garbsen (29 ha).

A look at the development of commercial space potential compared to the previous year shows that only one municipality was able to record a significant increase (> +2 ha) in the potential supply of space.

- Burgwedel : With an increase in land potential of 3.1 ha, Burgwedel is the only municipality represented in this category. The increase is due to the new registration of the Kleinburgwedel industrial estate, industrial estate III, which contributes 4 ha to the land balance and thus more than compensates for a sale of 0.9 ha.

In 15 municipalities, the supply of space has changed only slightly (< +/-2 ha), whereas the supply has decreased by more than 2 ha in the following five cities and municipalities.

- Barsinghausen: At -12.5 ha, the most significant reduction in available land is in Barsinghausen. This is due to the fact that the use of the Bantorf, Landerkamp site as an industrial estate is currently not being pursued.

- State capital Hanover: The reduction of -11.1 ha is mainly due to the late registration of a large land sale in the Lahe/Kirchhorster Str. industrial estate.

- Langenhagen: The decrease of -7.6 ha is due to two sales by non-municipal owners and the reclassification of an area as fallow land.

- Garbsen: The decrease of -6.1 ha is due to the recording of the area potential of the Osterwald-Unterende industrial estate, north of Koppelknechtsdamm, as a net area instead of the previous gross area.

- Burgdorf: The reduction in the area potential by 3.6 ha is due to a utilization decision as an expansion area in the Neuer Bauhof industrial estate and the sale of land in the Northwest Industrial Park (third construction phase).

Potentially reusable brownfield sites

It is not only in conurbations such as the Hannover Region that the development options for new greenfield commercial sites are increasingly reaching their limits due to competition for land and requirements for open space protection.

For this reason, the revitalization of brownfield sites, the careful use of land resources and the redensification of use in existing commercial areas are among the central objectives of municipal commercial space policy.

In this context, brownfield sites are defined as areas formerly used for commercial purposes that are fundamentally suitable for commercial reuse but cannot be mobilized via market mechanisms due to significant obstacles to use such as contaminated sites, old buildings or planning restrictions and therefore trigger a need for public action.

An indication of considerable restrictions on use is a longer vacancy period than is usual on the market. A significant size of the property is also a prerequisite for the need for public action.

According to this definition, ten properties with 87.7 ha are included in the commercial space monitoring, which are listed in the following table in alphabetical order of the surrounding municipalities and the state capital Hannover (Table 3).